State tax return estimator

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. DATEucator - Your 2022 Tax Refund Date.

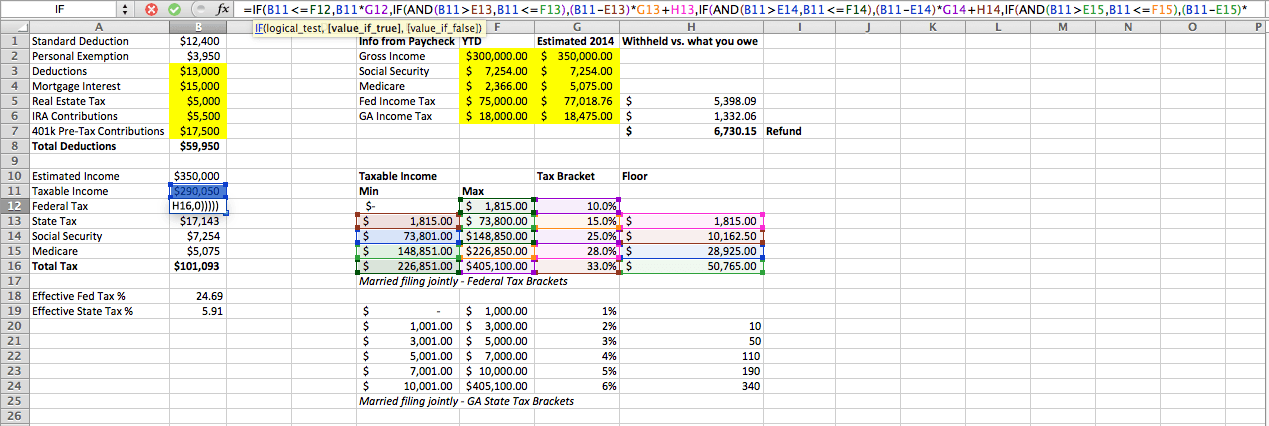

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

This calculator does not figure tax for Form 540 2EZ.

. We strive to make the calculator perfectly accurate. IT is Income Taxes This calculator is integrated with a W-4 Form Tax withholding feature. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Individual income tax refund inquiries. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Do not include dollar signs commas decimal points or negative amount such as -5000. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe.

Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page.

Up to 10 cash back Estimate your federal tax refund for free today. Estimate Today With The TurboTax Free Calculator. Multiply the amount on line 63 by the percentage you found in the chart above to estimate your payment for this credit.

Do not use periods or commas. Were not eliglible to be claimed as a dependent in the 2020 tax year. Were a California resident for six months or more of the 2020 tax.

Your average tax rate is 1198 and your marginal tax rate is. Find Fresh Content Updated Daily For Estimate tax return calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Your household income location filing status and number of personal exemptions. 2021 Tax Calculator Free Online. If you applied for an Individual Taxpayer Identification Number ITIN but did not receive it by October 15 2021 you must have filed your complete 2020 tax return by February 15 2021.

2021 Personal income tax calculator. Ad Calculate your tax refund and file your federal taxes for free. W-4 Pro - Tax Return Based W-4 Form.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. How Income Taxes Are Calculated. On Taxpayer Bs return t he line 19a amount is 18000 and the line 63 amount is 333.

No More Guessing On Your Tax Refund. Ad Plan Ahead For This Years Tax Return. This calculator is integrated with a W-4 Form Tax withholding feature.

Meet the California adjusted gross income CA AGI. Get Your Max 2021 Tax Refund. Filed your 2020 tax return by October 15 2021.

For 2022 Tax Estimates use this 2022 Tax Estimator. Wondering what to expect when you file your taxes this year. Filed your 2020 tax return by October 15 2021.

California Income Tax Calculator 2021. This calculator is for 2022 Tax Returns due in 2023. Enter your taxable income from Form OR-40 line 19.

2022 Tax Calculator Estimator - W-4-Pro. You are eligible for the Middle Class Tax Refund if you. Ad Aprio performs hundreds of RD Tax Credit studies each year.

Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate. Be Prepared When You Start Filing With TurboTax. Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Meet the California adjusted gross income CA AGI limits described on the Middle Class Tax Refund page. The provided information does not constitute financial tax or legal advice. If you make 70000 a year living in the region of California USA you will be taxed 15111.

2019 Individual Income Tax Estimator 2020 Skip to main content. Taxpayer Bs line 19a amount 18000 is in the 10000 to less than 25000 range in the chart so their payment is 75 of the amount on line 63. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

You are eligible for the Middle Class Tax Refund if you.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Indiana Income Tax Calculator Smartasset

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

How To Calculate Taxable Income H R Block

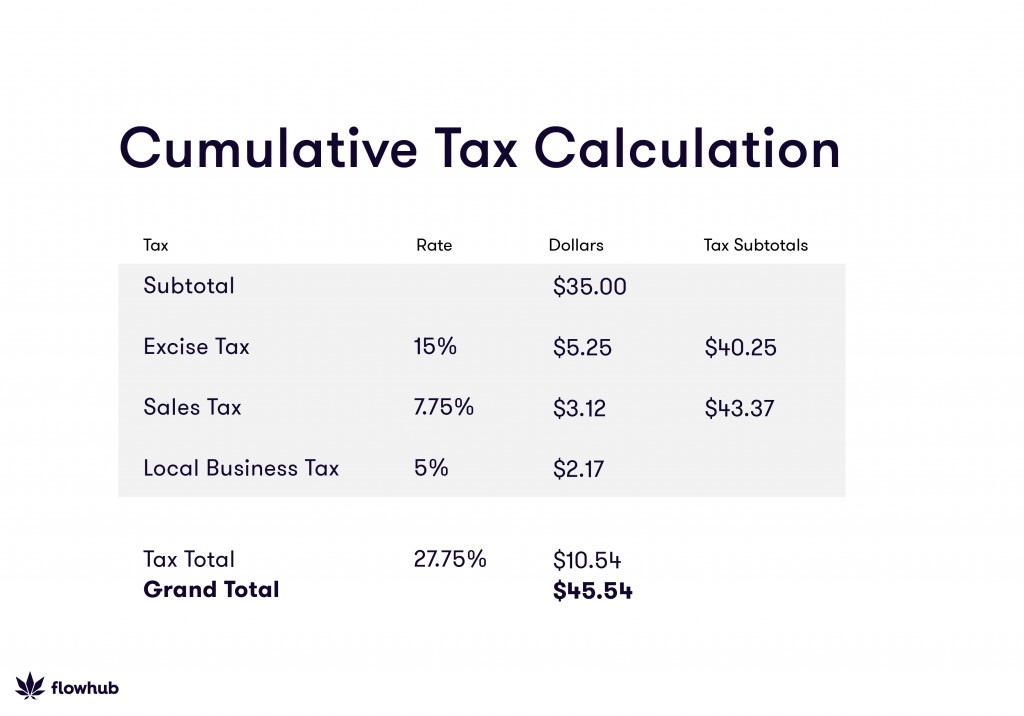

How To Calculate Cannabis Taxes At Your Dispensary

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Withholding For Pensions And Social Security Sensible Money

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

How To Calculate Federal Income Tax